The End of the World As We Knew It

10 years ago: remember? 2007 saw an extreme manic state in the American economy. The house market was exploding – household wealth was at an all time high over $65,000. Wealth was keyed to the growth in value of our homes – over $265,000 for the first time in 2007. It was unlike any time in economic history.

10 years ago: remember? 2007 saw an extreme manic state in the American economy. The house market was exploding – household wealth was at an all time high over $65,000. Wealth was keyed to the growth in value of our homes – over $265,000 for the first time in 2007. It was unlike any time in economic history.

Architecture loses all perspective in economic ebbs and flows. During boom times everything for architects (at every gathering) is “GREAT!” In bust times architects find few saving graces – but this last decade has seen a seeming permanent shift to reduced employment, building rate and expectations.

Remember that the late 1990’s had seen the “Tech Bubble” burst: new internet and cyber technology ventures simply failed to generate money, so public offerings and venture capital went bankrupt. Before that it was a gas crisis. Before that it was a Savings and Loan Crisis. There was a stock market crash in 1987. Before that it was another gas crisis. Specific parts of the typical series of boom-busts had parts of architecture expand and contract: regionally, by building type or just in relevance.

In one of those crises, an architect wrote the CTAIA and noted “Designing homes is a nice stepping stone until real work comes along.” Not quite “location, location, location” in terms of architectural anecdotes, but it accurately describes how 90% of the practice of architecture views the house market: high on pandering style marketers, low on relevance and innovation for the average housing consumer.

There has always been a free market rollercoaster that architects responded to, but in 2007 house architects were at the heart of a juggernaut: unprecedented growth in home building overcame the usual ebb and flows of supply and demand.

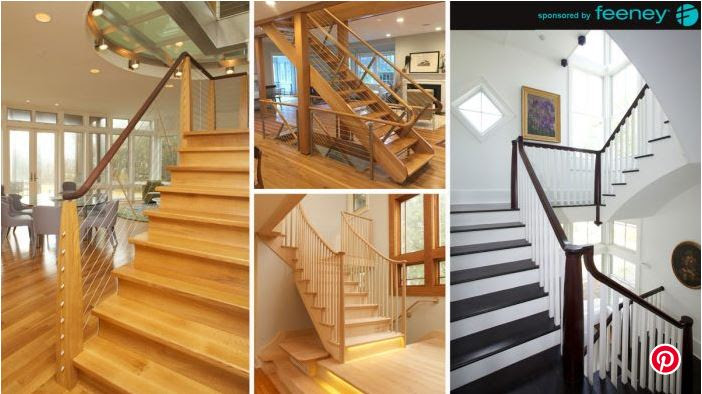

Everybody was getting rich, because a common good – the buildings we lived in – were part of a government-promoted, bank-fired effort at universal home ownership. You could buy a wreck, add paint and pansies and make 5 figures in 6 months. Even though residential architects designed a tiny percentage of new and renovated homes, self-declared residential architecture firms almost doubled as a percentage of the American profession: trending to 20% of all firms, up from around 10%.

I had designed homes for over 25 years, through all those ups and downs. I warned against the insane rise in construction and land costs, the irrational exuberance in house pricing, but had work, and talked to many professional groups and wrote about value, rather than trends.

For house architects 2007 was the best of times. 3,000,000 new homes a year, a decade or more of housing leading the U.S. economy through that Tech Bubble collapse. Home values outstripped the Stock Market as a wealth engine for middle class incomes. Home ownership reached 69% of adults – a worldwide record.

Hanley Wood had created Residential Architect magazine, This Old House was in new popularity, a new effort Inspired Home was launched by Taunton, along with a PBS series and web multiplatform intent with John Connell as the face. Special features in professional magazines and newspapers on Home Design went far beyond Record Houses or the Home Section (I was in both).

Harvard’s GSD’s Professional Program has had a “house” course created by Jeremiah Eck taught to professionals every year for nearly 30. I often talked there in boom and bust. In the first years of the 21st century attendance grew, price tags were hiked – more fees, staff, availability made for optimism – record attendance.

Residential Architect magazine launched a national conference, Reinvention, that was celebratory and very well attended. “Home Shows” exploded as did efforts at home plan services.

The AIA replaced the custom home side of its Housing Knowledge Community with a brand new Custom Residential Architect Network was launched. The new Congress of Residential Architecture had 20 national chapters and was piggy-backing on Reinvention national gatherings. There were invigorated house-center program foci for AIA chapters in Minnesota, Boston, Texas, California and New Jersey – and others.

It was as if the world had come to value what I had dedicated 25 years of my life to building. I was skeptical –as I had lived through 3 recessions with no lay-offs or missed bills, but my $150 an hour fee was often seen as “cheap”.

Then the insane overvaluation of homes could not be sustained by the realities of worth. Demand was not legitimate if those debtors getting funds from lenders could not make the payments to validate inflated prices. Without greater than inflation value explosion, no one wanted the risk. When those over-leveraged saw the value of the homes slide far below their debt, demand was killed.

The “Housing Boom” became the “House Bubble”. And burst.

And tanked the world economy.

For the first time, a building type in one market: the U.S. home, cratered its economic viability and colapse the economic industry that had propped it up.

The AIA lost membership, Architect unemployment went to 14%. Many firms simply ceased to exist. Magazines, hit by the double whammy of the burst bubble and the Internet Revolution lost cutting edge paper in Dwell, Residential Architect, Home. No more Reinvention conferences by Hanley Wood.

Las Vegas and Phoenix went from boom to depression when it came to the house market. Michigan, California and Arizona had home ownership decline by over 20% after 2007. The stock market crashed, unemployment spiked, and many simply stopped looking to work. Spec building ground to a halt.

Average house size grew as only the rich were building. Mortgages became insanely hard to obtain, many architects, builders, building product companies simply disappeared in 2 years. I was losing jobs because my 10 year-old $150/hr. rate was “too expensive”. I always had work, but had more pro bono work and smaller projects – and a 2007 payroll. I had the projects, if not the billings, to never downsize. Product producing companies lost marketing budgets, so there were no speaking fees, often no conferences.

In the confused depression going to school seemed better and better as a safe place where cyber gamesmanship supplanted the unquestioned basis of building in the world of architecture.

But it is not “better” in this the post-burst bubble decade – there may be more work, NYC, San Francisco, Boston have or had booms. “Houzz” and the like is exploding. But the central belief that the best investment, the most dependable place to put money and debt was where you lived is lost.

Architects had been drunken in their preconceptions of worth and inevitability, and the hangover of doubt and self-reproach has been worsened by a decade where technology has continually eroded the job market for architects.

Architecture, as with many fine arts, surfs upon the money available to fund expression. The U.S. economy lost $14 trillion in economic activity from 2007 thru 2009.

The first 7 years of the 21st century offered a tsunami for us to surf upon. Architects wiped out in the flood.

Why did we do this to ourselves? Building is an elemental human act – literally akin to wearing clothes and eating. It’s easy to confuse desire and greed for value and worth.

No matter what economy, architects would be in transition to a new future as technology changes, but the crater left by extreme economic distortion has yet to return home design to “normalcy”. Common sense disappears in a bubble: even for our most basic of possessions – like homes.

The beauty of our houses is not wishful thinking: applying an architect’s vision, at any price point, should have obvious relevance to any housing consumer. But just like 2007 mortgages, when values are in conflict, everyone loses.

Trackbacks